- Home

-

- Business Dialogue 2021 Vol.1 No.3

Business Dialogue 2021 Vol.1 No.3

The CBM Business Dialogue Exercise

Main findings from the 2021 Q3 round of contacts with non-financial corporations

Summary

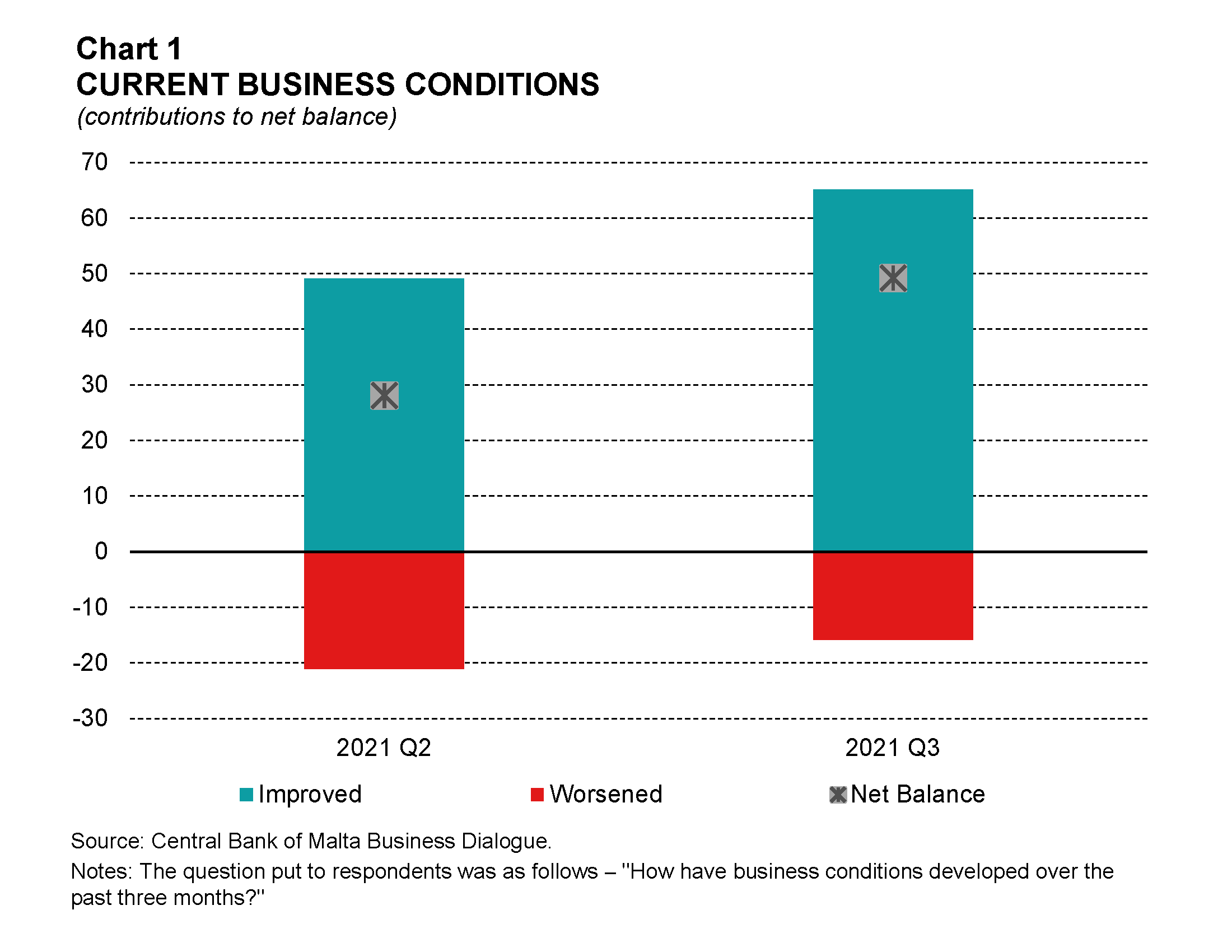

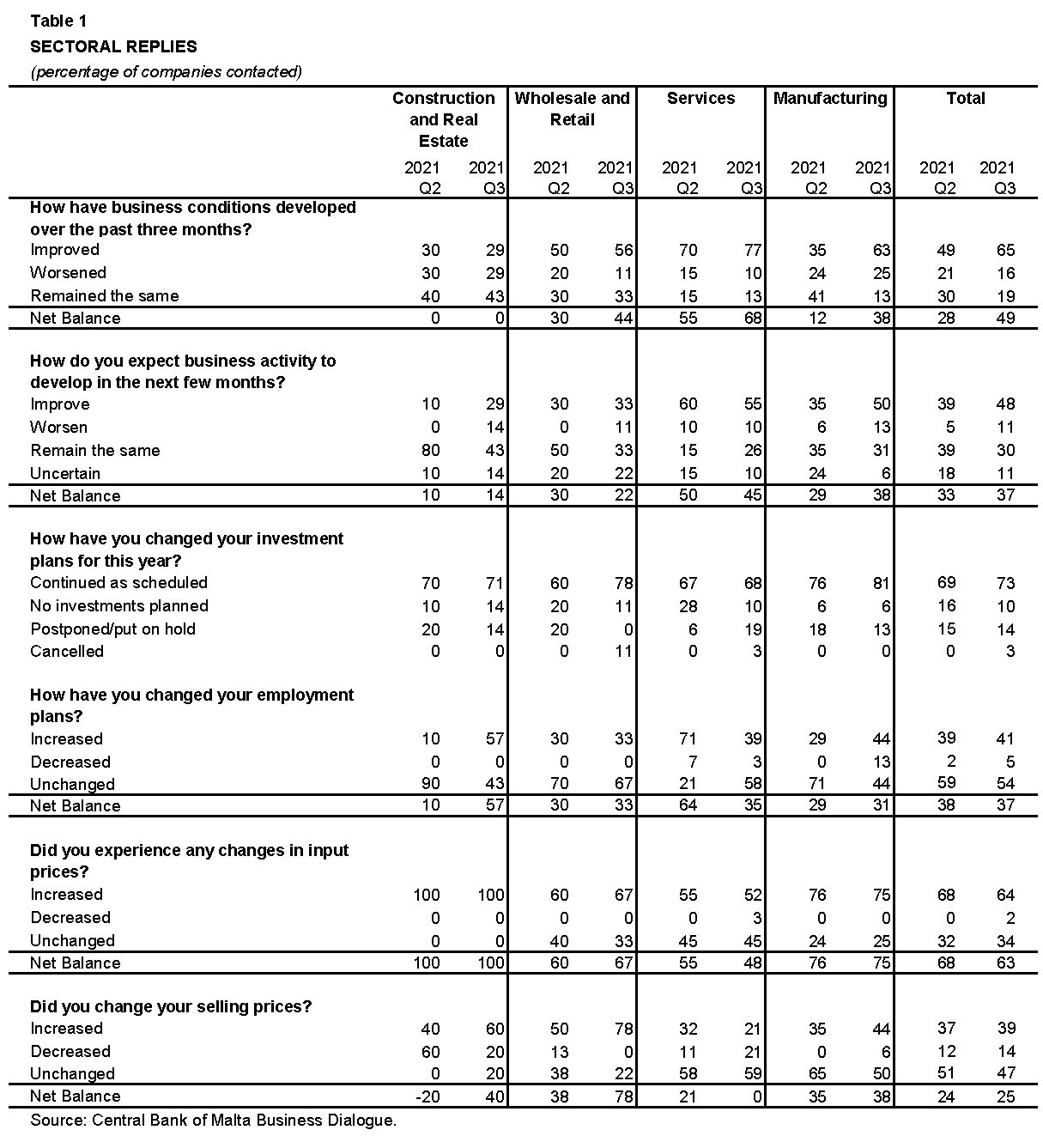

Information gathered during contacts that the Central Bank of Malta made between July and September 2021 indicates that overall business conditions have continued to improve significantly, with 65% of firms contacted reporting higher activity, while 16% reported negative developments. Thus, a net 49% of respondents reported an increase in activity over the three months preceding the interview, up from a net 28% in the second quarter.

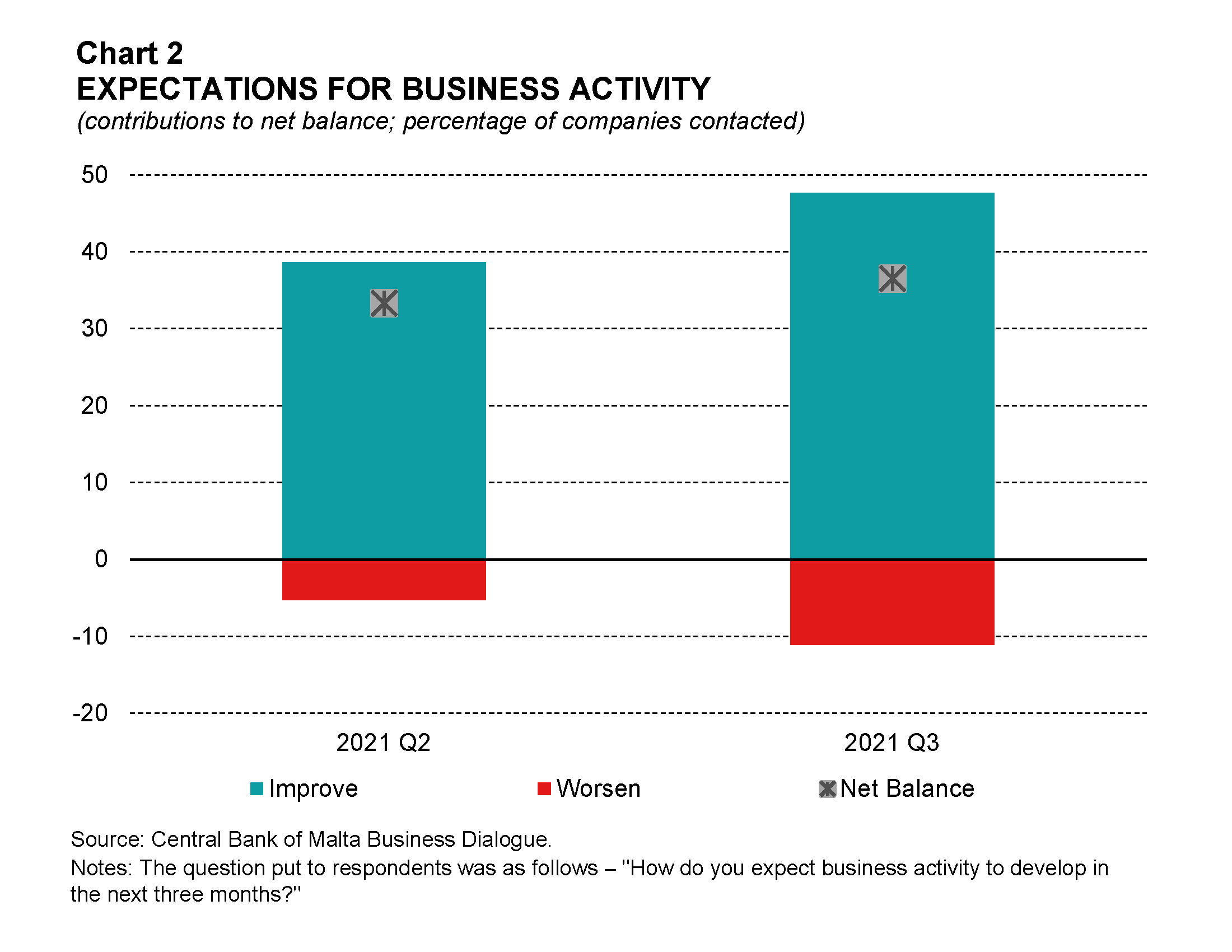

Short-term expectations about business activity also improved. Almost half of the contacts reported that they expect business activity to expand over the next three months, while 11% anticipated a decline. As a result, the net share of respondents expecting an amelioration in business activity increased to 37%, from 33% in the previous round. Moreover, the share of contacts reporting that the outlook was uncertain receded further.

Cost pressures have remained elevated in the quarter under review, and indeed, almost two-thirds of contacts reported that input prices have increased. In part due to elevated cost pressures, around 39% of firms interviewed reported an increase in their selling prices. However, 14% reported reductions in selling prices while almost a half of firms left selling prices unchanged. As a result, the net share of firms reporting price increases rose by only one percentage point, to 25%. This outcome, however, reflects a mixed picture across sectors, with selling price increases being reported more widely in the wholesale and retail sector than in other sectors.

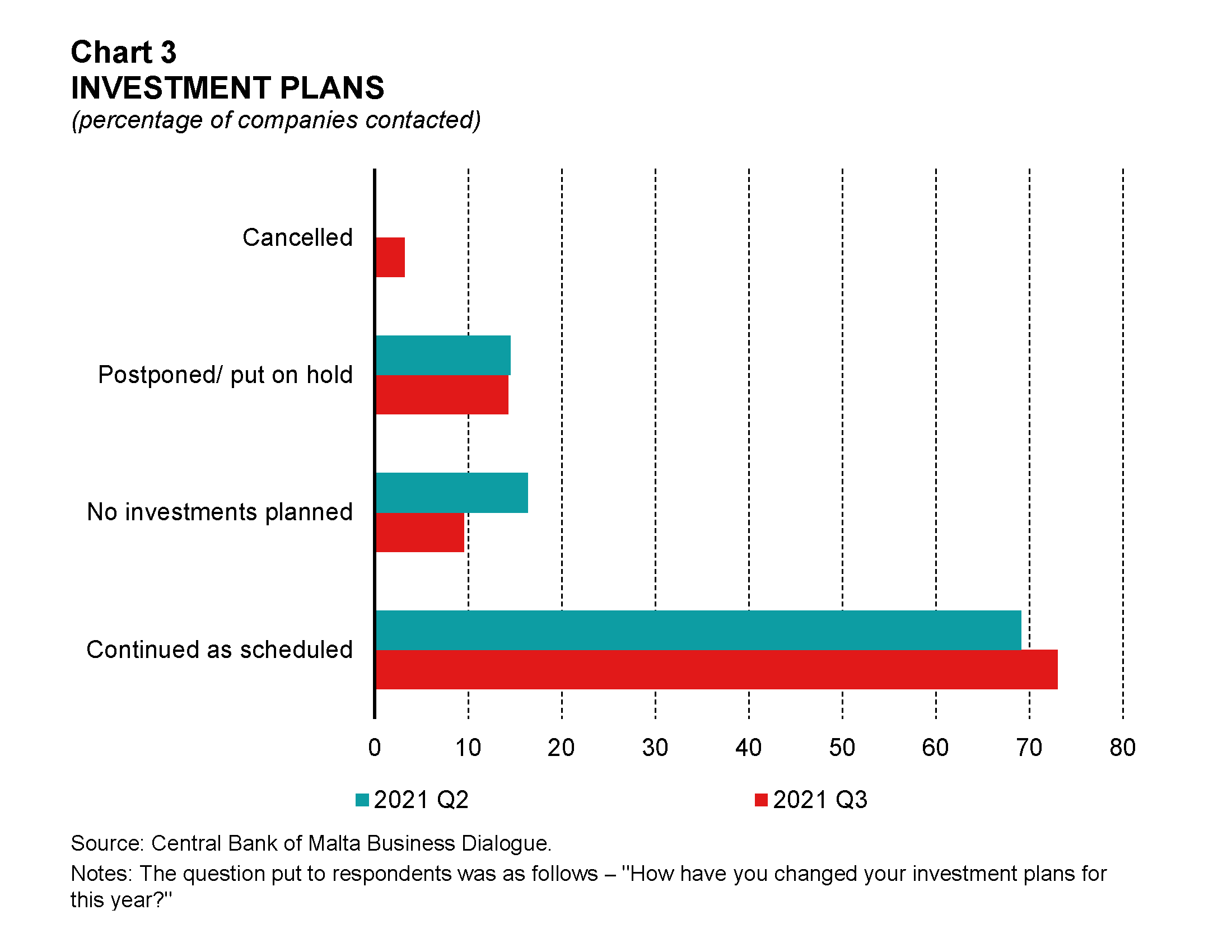

In the third quarter, 73% of respondents reported that investment plans continued as scheduled, slightly up from 69% in the second quarter. A further 14% reported postponement. The share of respondents reporting cancellations rose marginally to 3%.

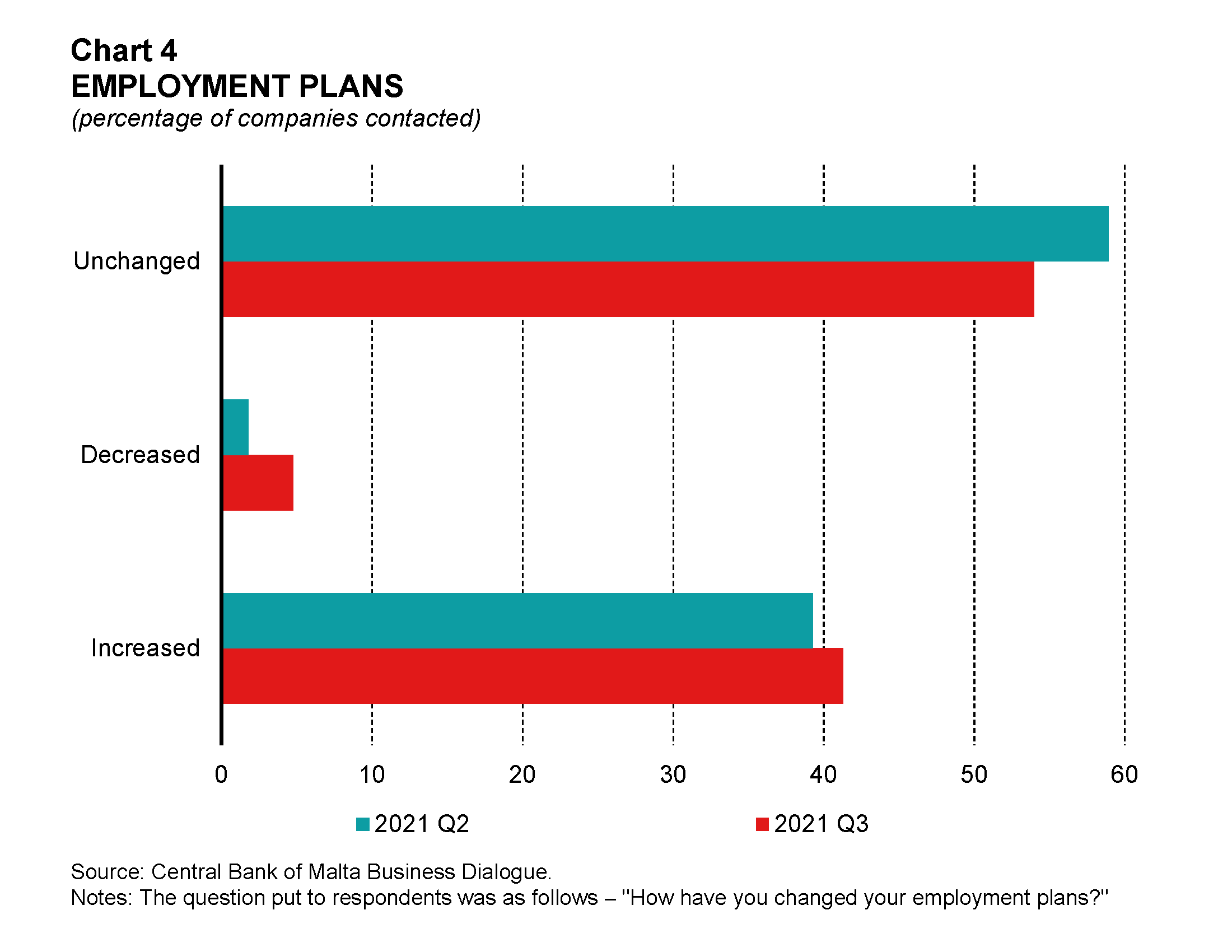

In view of the increase in activity, a net 37% of firms plan to hire staff, broadly in line with the previous quarter. However, more firms during the quarter under review have expressed concerns about labour shortages.

In the third quarter of 2021, a total of 66 telephone/virtual meetings with leading non-financial corporations were conducted. These include 16 manufacturing companies, 31 services-oriented companies, nine wholesale and retail companies, seven construction and real estate companies and three public/private institutions.1

Overall business conditions continued to improve

Information gathered between July and September 2021 indicates that - on balance - business conditions continued to improve. Indeed, 65% of the firms interviewed in the third quarter of 2021 stated that business conditions had improved over the past three months, up from 49% in the second quarter (see Chart 1). At the same time, the share of firms stating that business activity worsened fell from 21% in the second quarter of the year to 16% in the third quarter. Hence, a net share of 49% reported an amelioration in business conditions, up from 28% in the previous quarter. The number of firms stating that business conditions remained unchanged fell to 19% in the quarter under review, from 30% previously.

Business conditions continued to improve in the services, manufacturing, and wholesale and retail sectors, whilst activity in the construction and real estate sector was assessed to have stabilised. A strong majority (77%) of services-oriented firms contacted in the third quarter of 2021 stated that economic conditions had improved over the past three months. This follows an already high percentage of firms that reported an improvement in conditions in the previous quarter (see Table 1). Moreover, fewer firms stated that economic conditions had worsened compared to the second quarter. Reflecting these developments, the net balance of services firms reporting an improvement increased from 55% to 68%. This strong improvement was noticed across a broad range of services sub-sectors; however, the improvement in the accommodation and the maritime and freight sub sectors was more notable, possibly reflecting the continued easing of containment measures that were introduced earlier this year.

Business conditions also improved markedly in the manufacturing sector. The number of firms reporting an improvement in activity almost doubled, from 35% in the second quarter to 63% in the third (see Table 1). At the same time, a quarter of firms continued to report a worsening in business conditions - broadly in line with the second quarter - while 13% of firms disclosed that activity remained the same, down from 41% in the second quarter. Therefore, the net balance of manufacturing companies stood at 38%, up from 12% in the second quarter. This improvement was observed across most manufacturing firms contacted.

In the wholesale and retail sector, a net 44% of respondents assessed conditions to have improved in recent months (see Table 1), up from 30% in the second quarter. Furthermore, the share of respondents stating that conditions worsened broadly halved, while those confirming unchanged conditions remained stable. A pickup in demand was reported by firms that sell durables and electronics, automobiles, and clothing and footwear.

Expectations for short term business conditions improve moderately

Looking ahead, almost half (48%) of the firms contacted during the third quarter of 2021 anticipated their business activity to improve further over the next three months, up from 39% in the previous quarter (see Chart 2). Nonetheless, the number of firms which expected conditions to worsen over the next three months has risen from 5% in the second quarter to 11% in the quarter under review. Consequently, the net share of firms reporting improved expectations increased to 37%, from 33% in the previous quarter. Fewer firms expect conditions to remain the same. The increase in the net balance of firms reporting an amelioration in short-term business conditions was mostly driven by the manufacturing sector and, to a limited extent, by firms in construction and real estate.

Meanwhile, the share of respondents reporting an uncertain outlook declined from 18% to 11% in the third quarter, reflecting a brighter outlook for short-term business conditions in the manufacturing sector and, to a lesser extent, in services.

Indeed, half of the manufacturing firms interviewed in this quarter expected an improvement in their business activity over the next three months, an increase of 15 percentage points when compared to the previous quarter (see Table 1). Meanwhile, 13% of manufacturing firms expected conditions to worsen, up from 6% in the previous quarter. These are firms involved in the manufacturing of electronic products. Approximately the same number of manufacturing companies as in the previous quarter stated that conditions were expected to remain the same, while only 6% of firms were still uncertain of short-term conditions, down from 24% in the second quarter. The net balance of firms reporting improved business expectations within this sector therefore stood at 38%, up from 29% in the second quarter.

On balance a small improvement is expected in activity of the construction and real estate sectors, with the net balance reaching 14%, from 10% in the second quarter. Almost 30% of businesses in this sector expect an improvement in activity over the next few months, up from 10% on the second quarter (see Table 1). Yet, 14% expect conditions to worsen, up from 0% previously. Uncertainty has receded, as 43% of companies in these sectors anticipate unchanged business conditions, down from 80% in the previous round of contacts. Another 14% are still uncertain of future conditions.

Within the services sector expectations are also positive - although the number of firms expecting an improvement in the next three months fell from 60% in the second quarter to 55% in the third (see Table 1). In the meantime, the share of services firms expecting conditions to worsen was unchanged at 10%. As a result, the net balance dropped by 5 percentage points in the quarter under review, to 45%. Compared to the second quarter, fewer firms in this sector said that they were uncertain about the immediate future, while the share of respondents expecting no major changes almost doubled to 26%.

In the wholesale and retail sector, a net 22% of firms contacted between July and September 2021 expected sales activity over the next three months to improve, down from 30% in the second quarter (see Table 1). This reflects an increase in the number of companies expecting lower sales, which outweighed the small rise in sellers expecting an increase. At 22%, the share of firms reporting uncertainty remains elevated compared to other sectors and marginally above that in the second quarter. Firms expressing this view were mainly retailers of durables, electronics, and clothing and footwear.

Firms' investment and hiring plans are encouraging

During the initial stages of the pandemic, a substantial number of firms had halted their investment plans, primarily due to the elevated level of uncertainty. However, the survey shows an increase in the percentage of companies that have continued with their investment plans in recent quarters. Indeed, almost three-fourths of companies contacted during the third quarter of 2021 reported that their investment plans remain on track, compared to 69% in the previous quarter. This was partly because some of the projects had been committed far in advance or work had already started (see Chart 3). The number of companies claiming that they postponed or paused their investment plans and adopted a 'wait-and-see' approach remained broadly unchanged to the previous quarter's, at 14%. Moreover, only 3% of the firms contacted cancelled their capital expenditure. These companies operate in the wholesale and retail and in the services sector. Around a tenth of the contacts made in the third quarter claimed that they did not have any investments planned, compared to 16% in the previous quarter.

Looking at investment plans by sector, 81% of manufacturing companies contacted in the third quarter reported that they had continued with their plans, while 13% postponed their investments (see Table 1). The share of firms reporting that investment plans have continued as scheduled was also high in the wholesale and retail sector, at 78%. This share was lower in the services sector and in real estate and construction, where slightly more than two-thirds of respondents continued with their planned expenditure.

When asked about employment plans, the responses collected reveal a small increase in the share of firms that plan to recruit more staff, with 41% of all firms interviewed planning to increase staff. This was slightly up from 39% in the second quarter, but significantly more than what was recorded in previous quarters. The share of firms expecting to shed labour increased slightly to 5%, from 2% in the previous round (see Chart 4). However, these are mostly companies that are not replacing workers who voluntarily resigned. Consequently, a net 37% of respondents anticipate higher employment, marginally below a net 38% in the previous quarter. The share of respondents that did not alter their employment plans also decreased to 54%, from 59% in the second quarter of 2021. This mainly relates to companies that are only recruiting for replacement purposes.

While the Wage Supplement Scheme continues to provide some support for businesses, it is no longer a major factor in sustaining employment. Indeed, firms are currently highly concerned about shortages of labour and skills.

A higher net share of firms planning to increase employment was recorded in all sectors, barring services (see Table 1). In particular, a net share of 57% of construction and real estate firms interviewed plan to increase their staff complement, sharply up from 10% in the previous quarter. Moreover, the net share of firms within the manufacturing sector which replied that they plan to recruit stood at 31%, up from 29% in the previous quarter, while that in the wholesale and retail trade sector increased from 30% to 33%.

Conversely, there was a notable decrease in the share of services firms that plan to increase the staff complement. Indeed, a net 35% of services-oriented firms plan to recruit, sharply down from 64% in the previous quarter. This follows a surge in recruitment during the second quarter, which reflected the strong recovery in demand for services following the lifting of COVID-19 restrictions and hence an urgent need for workers. Nonetheless, notwithstanding the recent decrease, the net balance of services firms expecting to hire staff remains comparable to that in manufacturing, construction and real estate.

Despite the relatively small increase in demand for labour during the third quarter, most firms interviewed continued to insist that the shortage of labour is a major concern and that they are finding it increasingly difficult to recruit new employees. This sentiment was expressed by firms across all sectors but was more pronounced amongst those operating in the services industry. Companies said that the situation is similar or slightly more challenging than the period prior to the pandemic, mainly because of limited access to third-country nationals. This labour shortage was in turn leading to upward wage pressures, with firms also reporting increased instances of poaching and staff turnover.

Supply chain and costs pressures remain elevated

A significant number of firms continued to indicate that supply chain disruptions remain elevated. Although firms in some niche sectors reported a slight easing of pressures, many affected firms reported continued or intensification of disruptions. Firms are especially concerned about delivery delays, with lead times increasing drastically as shortages of imported materials and shipping options have intensified. Moreover, many firms lamented about the rise in global transportation costs. This issue has now become a key concern for almost all importing firms, especially those importing from outside Europe. Higher transport prices mainly reflect the international shortage of containers, low competition in the global shipping market, COVID-19 port restrictions and reduction in available sea and air routes to Malta.

Supply concerns were particularly prevalent among firms operating in the manufacturing and trade sectors. In many cases, delays and shortages have led to disruptions in activity and losses in revenue. The international shortage of microchips is a particular issue for both sectors. In the trade sector, several firms also mentioned Brexit as a source of disruption, mainly relating to delays, cost increases, and increased bureaucracy. These shortages and delays are in some cases forcing companies to overstock, in turn leading to higher storage costs and cashflow issues.

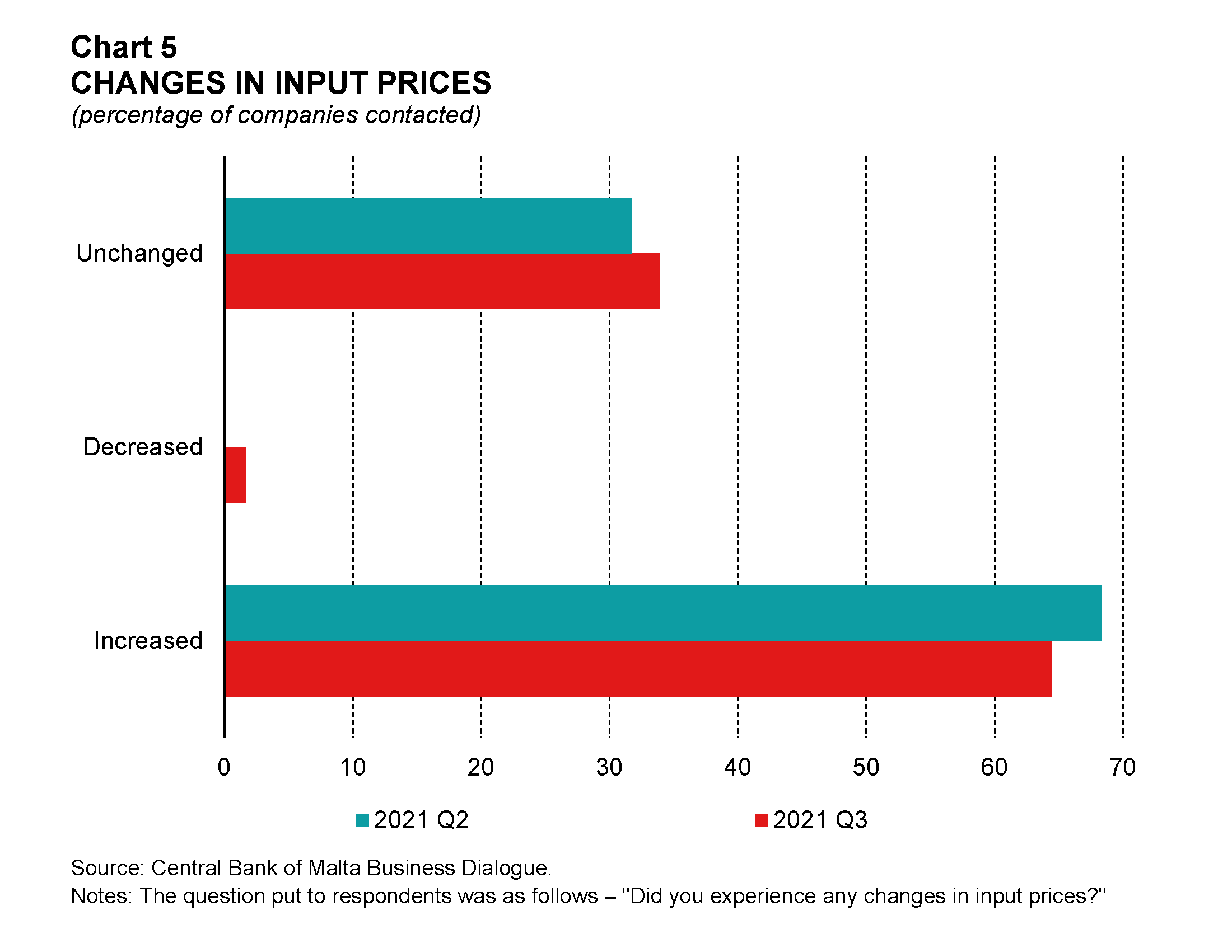

Apart from supply chain disruptions, firms are also grappling with increases in production costs. Many firms contacted during the third quarter of 2021 (64%) reported an increase in input prices, slightly below the 68% reported in the previous exercise (see Chart 5). At the same time, only 2% of firms reported a drop in input prices, from zero in the previous quarter. The remaining 34% reported stable prices, marginally above the figure of 32% recorded in the previous quarter. As a result, the net share of respondents reporting that they have experienced an increase in input costs decreased slightly, but remained elevated, at 62%.

At a sectoral level, all firms in the construction sector, 75% of firms in the manufacturing sector and two-thirds of firms in wholesale and retail reported that input costs had risen recently. More than half of services firms also reported increased material costs. Decreases in input costs were only reported in a very small minority of services firms. Compared with the previous quarter, the largest increase in the net balance of firms reporting higher input costs was recorded in the trade sector, even though, as noted above, the balance remained below that in construction and manufacturing.

Across all sectors, the number of firms reporting increased costs for raw materials and other production inputs has increased significantly since the start of the year. Other than higher freight costs feeding into raw material prices, factors driving these increased costs include higher international prices for inputs amid global shortages. Firms operating in the construction and manufacturing sectors reported higher international prices for steel and wood, as well as other materials such as plastic and paper. On the other hand, firms operating in the services sector were more likely to report increased costs related to COVID-19 preventative measures, including reduced capacity and social distancing.

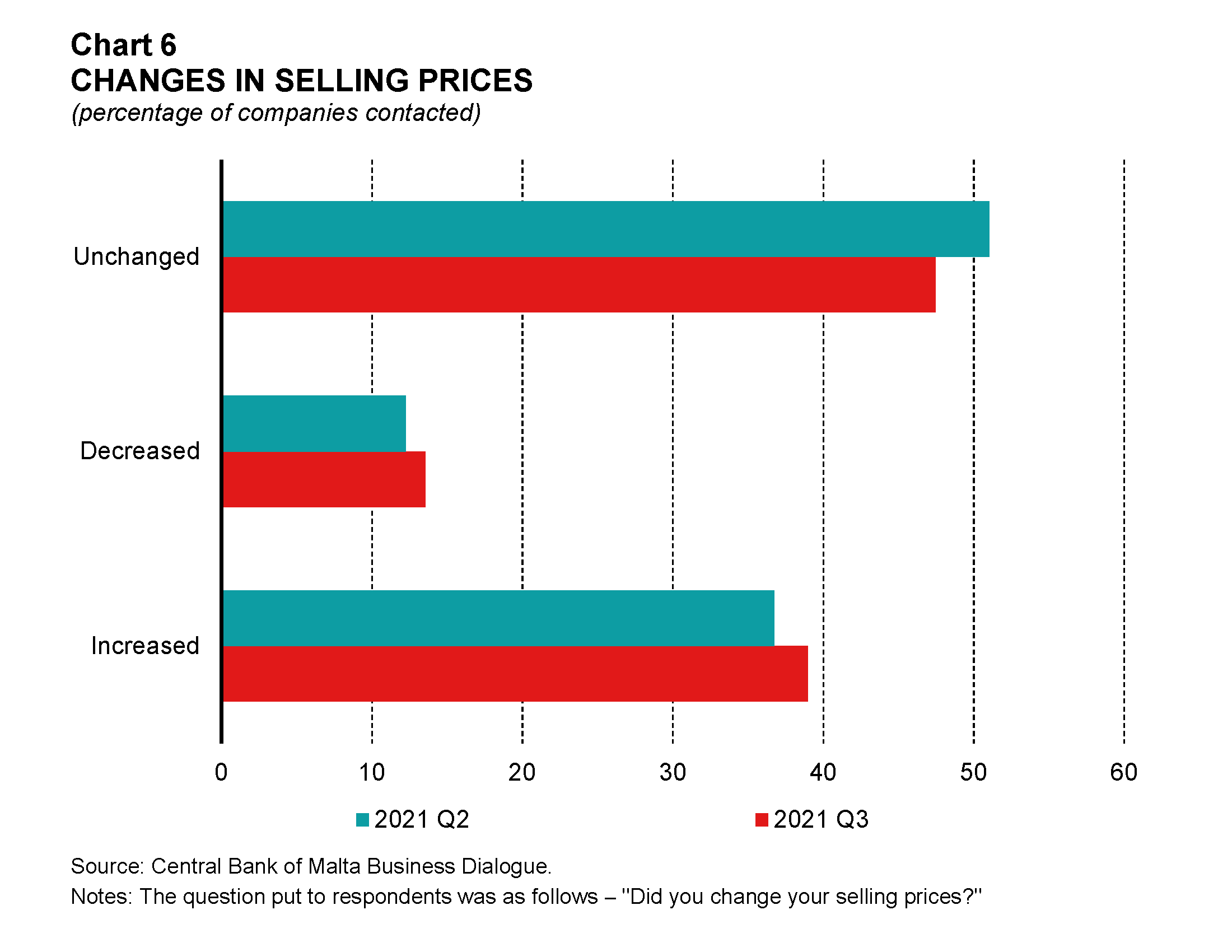

Mainly as a consequence of the steep increase in input prices, 39% of firms reported an increase in selling prices during the third quarter of 2021, slightly higher than the 37% recorded in the previous quarter (see Chart 6). Only 14% of respondents reduced prices, while 47% maintained stable prices. As a result, the net balance of firms reporting higher output prices stands at 25%, up by just one percentage point over the previous quarter.

At a sectoral level, the net balance of replies to this question turned positive in construction and more than doubled in the wholesale and retail trade sectors. The net share of firms increasing selling prices also rose in the manufacturing sector, though the increase was much more limited compared to that in construction and trade.

By contrast, almost 60% of respondents in the services sector left selling prices unchanged. The remaining firms were almost evenly split between price-increasing and price-reducing firms - with lower prices mostly an attempt to encourage demand by firms operating in the tourism sector. As a result, on balance unchanged selling prices were reported in this sector. This contrasts with the second quarter, when a net 21% of services firms had reported price increases.

Annex

1 More information on the structure, methodology and evolution of the CBM Business Dialogue exercise can be found here.